In addition to our “day job”, most of us look for a higher purpose in life by contributing in different ways to the community at large. For many self-motivated and tenacious individuals, they choose to address a specific need “to do good” in a structured

manner: by setting up a Social Enterprise (SE) to sustainably impact the community, its people and the environment.

In my four years of helming the Board at raiSE, it is the interaction with these social entrepreneurs that has been most fulfilling and rewarding. Their passion to help the less fortunate and their hunger for innovative ways to do so, have not only impressed

me, but also the rest of my fellow Board members and other stakeholders of raiSE. At this juncture, I would like to place on record my appreciation for the counsel and contributions of my fellow Board members and officials from the

Ministry of Social and Family Development (MSF), Tote Board and the National Council of Social Service (NCSS). We rarely succeed alone; the value of our work is directly attributed to the good men and women that we work with.

While I am encouraged by the milestones that raiSE has achieved, the potential of any organisation’s spirit and ability to make a positive impact on society is like an elastic band, the more you stretch its potential, the greater the outcomes. I applaud

the management and team at raiSE for always pushing the boundaries, especially since we are at the epicenter of a nascent eco-system.

Enhancing the Sector

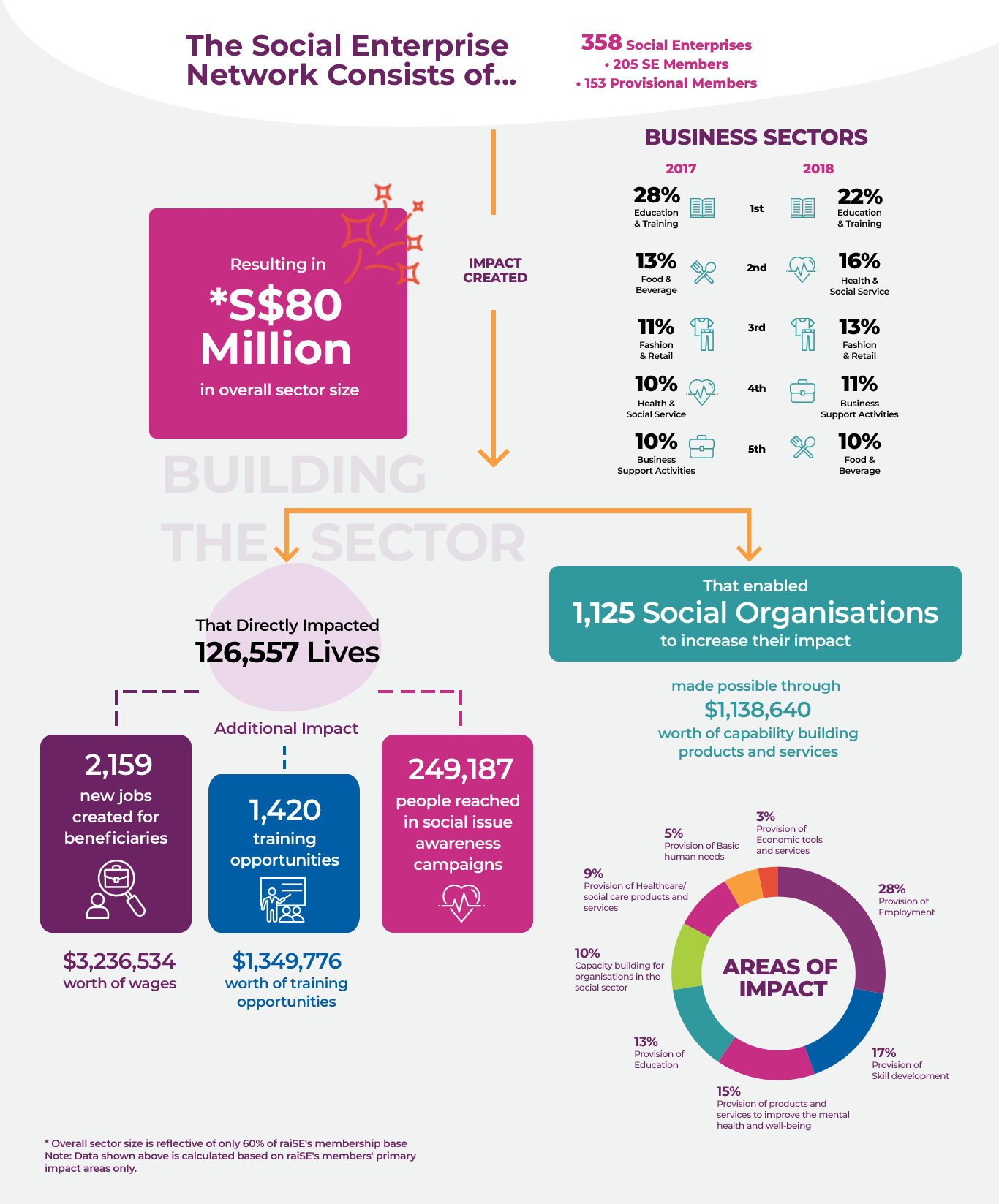

It is noteworthy to mention that a recent internal review concluded on 31 March 2019 presented that 60% of raiSE’s Social Enterprise members accounted for approximately S$ 80 million in revenue. This ability to correlate both the social and financial

value of Social Enterprises, legitimises their claim of a ‘double bottom-line’.

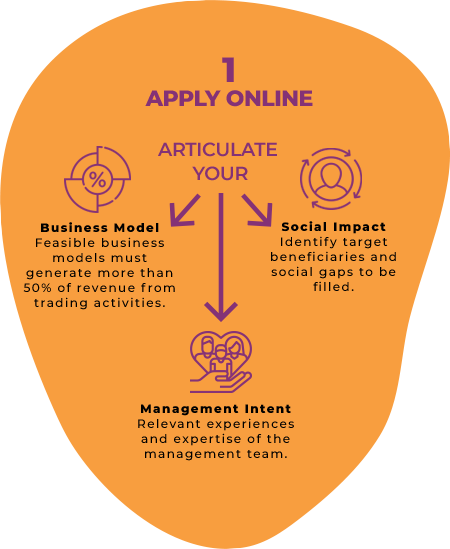

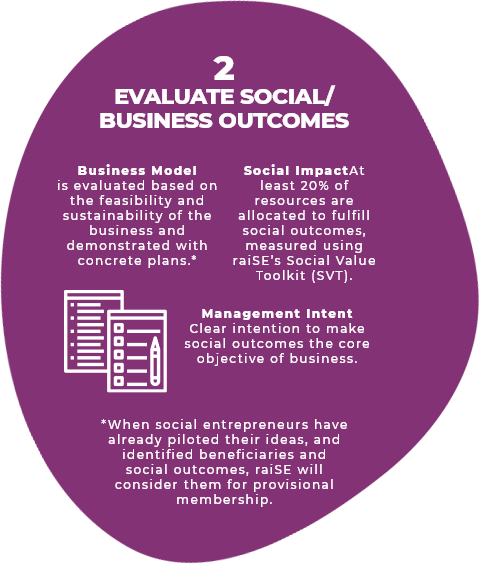

Since value and measurement go hand in hand, we have taken active steps in 2018 to tighten our membership framework and collect relevant data during the membership renewal process so that the credibility of the sector is maintained.

Through the analysis of the data collected, we have expanded our social impact indicators to be representative of the emerging needs that our members have been addressing; environmental indicators are an example of impact

areas that we are now evaluating.

Deepening Capabilities

Given the objective of being enterprise first, Social Enterprises need to be financially sustainable for them to solve some of our society’s pressing issues. At raiSE, we focus our resources on deepening the capabilities of our members so that they continue

to grow their social impact and contribute to Singapore’s economic growth.

The funding gaps of these Social Enterprises to some extent, have been addressed through our newly introduced raiSE Impact Finance Plus (RIF+) investment fund, accelerating their development not only through monetary means

but also through the provision of capacity building support as we play the role of a Venture Builder.

The introduction of the SE Fellowship Programme helped propel several growth-stage companies towards financial sustainability as the matching of senior corporate professionals to these Social Enterprises has given them the

much-needed dedicated support they require to excel in a sustainable manner. Following the success of the pilot run which saw the turnaround of five such Social Enterprises that not only scaled up financially but also increased their

social impact, we are now working on formalising the programme to assist more Social Enterprises.

Broadening Support

In order to meet emerging social and community needs, social service delivery must be a shared responsibility between an effective government, traditional charity models and private for-profit companies. Social Enterprises fill the gap by augmenting the

provision of social services through a hybrid model.

As Social Enterprises embody a revenue-generating mindset with a deep commitment to address one or more social issues, they present themselves as an opportune entity for corporates to work with, in order to achieve their environment, social and governance

(ESG) impact indicators sustainably.

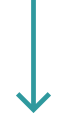

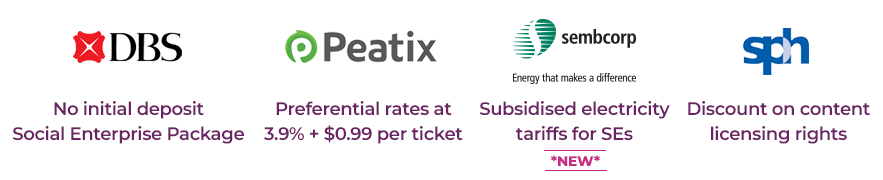

The inaugural SE Week 2018 is a testimony of the 3-P Partnership between the public, private and people sectors, as it garnered the support of SMEs and large corporates in Singapore to impactfully raise awareness and support

for social enterprises. As there is further assertion on a global scale for corporations to align with a larger sense of purpose that puts people and their environment first, I would personally appeal to corporate decision makers to

make Social Enterprises a part of their company’s sustainability journey. Incorporate them in your supply chain by procuring from them, start with skills-based volunteering or invest in them if there is alignment in your business

models.

In Closing

As Social Enterprises demonstrate that they can not only offer quality products and services but also value-add towards corporate sustainability goals, they will gain traction and be a cause worth supporting, not only from an impact investment perspective

but also for every individual to vote with their dollar.

At raiSE, we commit to continually improve the public’s understanding of Social Enterprises in Singapore. We believe that a better understanding and appreciation of the role, abilities and challenges of Social Enterprises in society at large will allow

for the creation of opportunities for these change-makers to increase their social impact in a more caring and inclusive society.

Thank you.

GAUTAM BANERJEE

CHAIRMAN, raiSE BOARD